By: Brett Redmayne-Titley

“It is easier to rob by setting up a bank than by holding up a bank clerk.” -Bertolt Brecht.

As a new global recession spirals into an economic depression, central banks have a Hobson’s choice: Stop rapidly rising core consumer inflation or stop national economic production deflation. The Bank of England cannot do both, and like the US Federal Reserve lacks the economic tools to deal effectively with either.

The British bank depositor is very much at risk.

The UK pound hit historic lows in value this month and all major banks are suddenly predicting doom. Ironically, these banks are today exponentially more over-leveraged with derivative exposure than when this same financial chicanery caused the 2008 Great Recession within the Home Mortgage sector. This time, with derivatives out of control in virtually all financial sectors, bank depositors would do well to comprehend several inconvenient truths, the first being that depositors, when demanding their money, are not first in line. Nor second.

Since you are tertiary in this vital financial relationship, when your bank fails…don’t walk. Run!

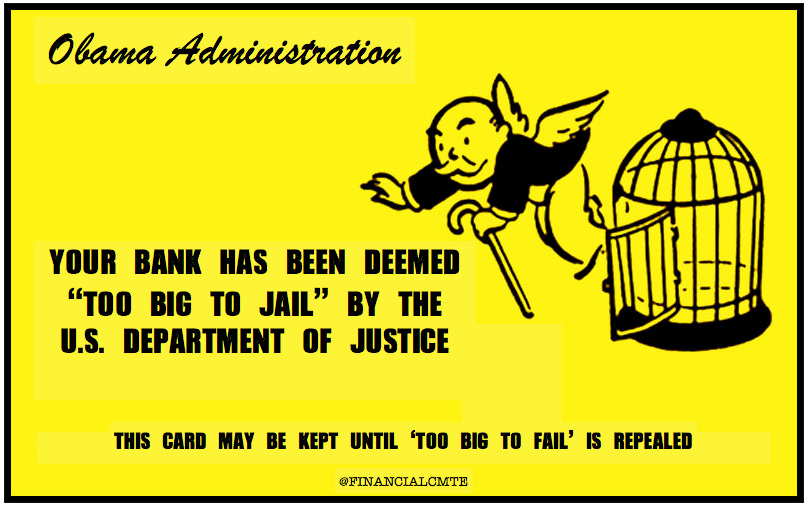

Since 2008, too big-to-fail banks consolidated to become much greater in size and power than ever. They're financial and political powerhouses controlling world economies to their advantage. For years, investment legend Warren Buffett called derivatives “financial time bombs” – for economies and ordinary people. It should be noted that former Fed Chairman, Paul Volker, resigned in January of 2011 from president Obama’s Economic Recovery Advisory Board, in disgust due to the renewed headwinds continuing to allow un-regulated derivatives.

The world economy’s current date with this new recession was prescribed in the aftermath of the 2008 crash when the US Troubled Asset Relief Program (TARP) stabilized the financial system by having the government buy worthless mortgage-backed securities and declining bank stocks for no less than $426.4 billion. TARP also called the tune on new surreptitious national legislation supposedly designed to forever eliminate the need for any new “Bail-out.”

After these global Bail-outs the preamble to the resultant 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, claimed: "…to protect the American taxpayer by ending bailouts.” The financial law firm Davis Polk estimates the final length of the Dodd-Frank model, the single longest bill ever passed by the US government, is over 30,000 pages. Before the bill’s passage, the six largest banks in the US spent $29.4 million lobbying Congress and flooded Capitol Hill with about 3,000 lobbyists for the bank’s protections, not yours.

Meanwhile, the US taxpayer watched as pension funds went bust, bankrupt businesses rid themselves of long-term retirement obligations and their family's financial futures were cast aside from any concern.

Under Dodd-Frank, the US Federal Deposit Insurance Corporation (FDIC) was given new powers and methods to "guarantee" depositors' savings." Under the direction of TARP, such powers were also included in Britain’s 2012 Prudent Regulation Authority (PRA) reform bill. Both agencies did put a stop to Bail-outs. However, they did so by miraculously morphing Bail-outs into something new called, “Bail-ins.” Worse, in redefining bank deposits, suddenly payback for pending bank failures shifted to the unsuspecting bank depositor.

Normally in any managed court-ordered business liquidation, such as before the bankruptcy of Lehman Bros in 2008 or Spain’s Bankia in 2013, a bank’s secured creditors- such as its depositors- are paid off first because theirs are hard assets when first deposited, not investments, nor speculation. These secured creditors normally had legal priority during liquidation. However, under the new “Bail-In” definition your cash deposits are now un-secured, but…. derivatives and other similar high-risk banking adventures will instead be paid before a depositor’s savings. If any.

Title II of Dodd-Frank gives the FDIC a new enforcement arm, the Orderly Liquidation Authority (OLA) which is similar to its British counterpart the Prudent Regulation Authority (PRA). Following suit, the Canadian government released a document titled the Economic Action Plan 2013 which says, “ the Government proposes to implement a ‘Bail-In’ regime for systemically important banks.”

Today, global exposure in derivatives by banks and financial houses has dramatically ballooned to more than one quadrillion dollars distributed over virtually all financial sectors. In 2008 it was only the housing sector. But, in 2010 the authors of Dodd-Frank did little about reigning in derivative trickery. On December 10, 2012, a joint strategy paper was drafted by the Bank of England (BOE) in conjunction with the FDIC which states in part, “… the authorities in the United States (US) and the United Kingdom (UK) have been working together to develop resolution strategies… to enable [financial institutions] to be resolved …without putting public funds at risk.”

Sounds nice until you read the fine print.

UK banks are currently required to hold a reserve of 18% of cash deposits. But this reserve is not applied to derivatives. Currently, UK banks hold trillions in derivative exposure. What this means for cash depositors is that applied to Dodd-Frank, OLA, PRA and failing banks, all these derivatives will be paid off first using your savings and your savings are now legally last in the minds of the banks.

Further, with US and UK banks holding $7 trillion and $1.4 trillion respectively in personal cash savings deposits the FDIC’s total war chest of $25 billion will not be quite enough. The latest Bank of England (BoE) data shows total gross derivatives assets and liabilities at £5.17 trillion – a 1% jump this year. In the USA it's 200 $Trillion plus. But, the PRA is underwritten by the Bank of England which is similarly cash strapped well below the new legal necessity to Bail-out this newly defined Bail-in.

The creators of Dodd-Frank and the PRA knew they were shifting this burden to the depositors before it was signed. As John Butler points out in an April 4, 2012 review in Financial Sense,

“Do you see the sleight-of-hand at work here? Under the guise of protecting taxpayers, depositors… are to be arbitrary, subordinated… when in fact they are legally senior to those claims…”

Millions across the world who had lost their homes, pension funds, retirement plans -and dreams– in 2008 watched helplessly as the Bail-outs did not trickle down from the “Too Big to Fail,” (TBTF) banks to their dinner tables or petrol tanks. Regarding new Bail-ins, however, in 2010, the previously bailed-out TBTF banks were also provided with a new, more hopeful definition: “Globally Active, Systemically Important, Financial Institutions” (G-SIFI).

By redefining Bail-outs to Bail-ins, Dodd-Frank gives new powers to the FDIC and the OLA and by extension PRA that provides for an even more draconian resolution: that any deposited funds in a bank can, in lieu of a cash payback, be returned to the depositor in the form of bank stock.

It gets worse.

An FDIC report released in 2012 reads: “An efficient path for returning the sound operations of the G-SIFI to the private sector would be …converting a sufficient amount of the unsecured debt from the original creditors [depositors] …into equity [stock].” An April 24, 2012, IMF report, also supported the conversion of bank deposits to stock using Bail-Ins.

Such was the case post-2008 in Cyprus, Greece and Spain. For affected depositors to retrieve the remaining cash value of what was formerly their cash account balance, the stock provided to them had to eventually be sold. When Lehman Brothers failed, unsecured depositors eventually received only eight cents on the dollar. Over a million Bankia customers in Spain, who were forced by decree to become stockholders, were returned just 5% when finally selling their stock.

Like Britain, America and most of the western EU nations, China now suffers from the conclusion of an economy based only on debt. On April 18 over 400,000 depositors of five regional banks in China’s Henan province were prohibited from making withdrawals. Despite the massive outrage the Chinese authorities did little except to promise a maximum paltry Bail-out of 50,000 Yuan. (USD$7445) However, this week, China mobilized its military to protect these same banks from public outrage after the CCP suddenly announced that the depositors’ remaining funds will now be repaid…with stock!

As the pound collapses, lay-off begin anew, fuel reaches historic highs and winter on the way, the bank UK depositor would do well to heed two other vital financial truths that the Chinese now consider self-evident. Never trust a banker, and…

When your bank fails, don’t walk…Run!

-THE END -

About the Author: Brett Redmayne-Titley has published over 200 in-depth articles over the past twelve years for news agencies worldwide. Many have been translated and republished. He can be reached at: live-on-scene ((at)) gmx.com. Prior articles can be viewed at his personal archive: www.watchingromeburn.uk

This is terrifying! So, are Credit Unions the way to go, or are they included in this fraud?